Welcome to the 3rd edition of the Tech Financial Planning Newsletter

So you just had some RSUs vest.

Should you sell and diversify or hold onto the stock (diamond hands - to the moon!)?

Enter the great financial planning mantra of “It depends.”

In this newsletter we will go over some important considerations for your RSUs, some reasons you might diversify, and some reasons you might hold.

TL;DR

When your RSUs vest, you have a lot to consider

Depending on your goals, it probably makes sense to sell some

If you want to hit it big (and it aligns with your plan) you can afford more risk.

Important considerations

If you are getting restricted stock units (RSUs) as part of your compensation, you have several things to consider, including:

Taxes

Financial planning

What to do after they vest

If you decide to sell some/all, what to do with the rest.

Once your RSUs vest, you gain full rights and ownership. They are yours to keep! But remember, you will have to pay taxes and your company might not withhold enough in taxes.

From there, you have a big decision to make: should you sell and diversify or should you hold?

This is a highly personal decision that can’t be made in a vacuum. Here are some questions to consider:

How much of my net worth do I want to be tied to my company’s performance?

Do my RSUs make me too concentrated in one stock?

If I hold on to my RSUs and the stock tanks, will I still be ok to reach my goals?

What other equity do I have through incentive stock options, nonqualified stock, or employee stock purchase plan?

Do I need cash for other areas of my life - a trip, a remodel, or kid’s college?

As you work through these questions, the answers will better equip you to decide if you should keep the shares or diversify. But let’s look at some reasons to diversify and some reasons to hold

Arguments for diversifying

Reason 1: You wouldn’t put all your money in your company stock.

A great question you can ask yourself: would you immediately buy stock in your company if it was a cash bonus? 99% of people would never take an entire bonus and put it in 1 stock.

Let’s say, instead of the $100,000 in stock, your company gave you a $100,000 bonus. Would you turn around and buy your company stock at the current market price?

If the answer is no, then it might make sense to sell some, especially if you plan to reinvest the money in a diversified portfolio.

Reason 2: No additional tax benefit

Another reason to sell RSUs when they vest is because there is no tax benefit to holding the stock any longer.

When your RSUs vest, you will have to report compensation income to the IRS. As in most areas of life, the IRS wants a piece of the action. You will be subject to taxes (federal, state, Social Security and Medicare). Usually, your company will withhold some RSUs to cover the estimated tax liability (but not necessarily all of it). Any remaining shares they put into your account as shares of your company stock.

If you sell these shares immediately (with no gain or loss since they vested), there will be no additional taxes from the sale. In our behaviorally biased brains, this money can feel wonderfully tax-free at the time.

Reason 3: You already have a lot of exposure to your company.

Think about it. You have a lot depending on your company.

Your income.

Your health insurance.

Your future unvested shares.

If your company stock goes off a cliff, you may get hit with a double whammy of investment and career risks at the same time.

I have always instantly sold my FB shares as soon as they vested. When asked why, my answer was always “I sell it as soon as they give it to me and toss it into index funds. I believe in the future success of the company, that is why I work here. All my unvested shares continue to ensure I have significant skin in the game. Plus, I work in tech. My wife works in tech. We live in San Francisco, which skews heavily influenced by tech. I sleep better with the reduced volatility that comes from diversification.

Better sleep isn’t something we usually think about, especially with investments. But if you can sleep better at night, it’s probably worth it.

Arguments for holding

Reason 1 You believe in the future of the company.

You believe in your leadership, both at your level and in the C-Suite. The company is consistently growing on the top and bottom line, and meanwhile the total addressable market continues to increase. Your company is continuing to grow market share.

If you are a staunch believer in your company, it may make sense to hold.

But I would be remiss if I didn’t put in a note of caution. People can be wrong on this all the time.

As my friend told me once: “It’s tough to balance enthusiasm for your company with diversification. In hindsight, I drank a bit of the Kool-Aid. As part of the company, you listen to leadership and see what’s on the company road map, so it’s easy to get too excited. Especially when the stock is down.”

Candidly, it depends on the company you work for. If you worked for companies like Apple or Nvidia, you made a killing the last few years. But if you worked for companies like Uber or Meta, you would have been better off diversifying.

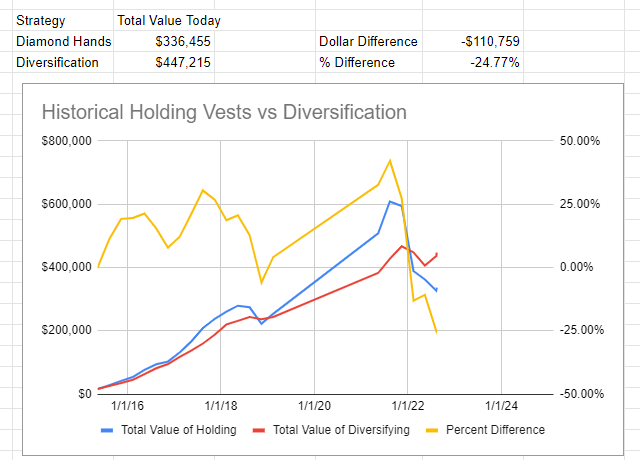

Example: holding vs diversifying META stock. As of today’s date, diversification is ahead by $110k.

Chances are, you aren’t working for the next Apple or Google. And likely you won’t know until years down the road.

Reason 2: You want to hit it big

Not retire & live comfortably big, but $10M + net worth big.

A great saying is that concentration creates wealth while diversification protects it.

Jeff Bezos, Elon Musk, and Mark Zuckerberg would not be as wealthy as they are if they had sold all their company stock and diversified years ago.

If that’s the case, you will want to take the additional investment risk and hold on to your stock.

Planning Note

You may not want or need to hit it big, and that’s ok. Most people’s needs and goals are much lower, so it may not be worth the risk.

Reason 3: You have room for error.

So if your company stock dropped 50% tomorrow, you’d still be ok. It doesn’t do anything to your current financial situation.

It doesn’t affect your retirement plans. Or stop you from buying a home. Your kids can still go to college. Maybe you can’t buy the nicer car or the bigger boat, but that’s ok. That’s the tradeoff you’re making.

We don’t want to make big bets on known expenses (college, house, etc). But beyond that, if you are comfortable with the risk, swing for the fences.

Reason 4: You have other forms of equity compensation

In addition to your RSUs, you have some combination of ESPP, NQSOs or ISOs. If this is the case, you want to think about your total stock compensation package.

Both the tax impacts, but also protecting against any downside risk.

There’s a ton of different scenarios, this could be an article in itself. So we’ll skip this one for today. But if you want to take a deep dive, Daniel Zajac has a great overview on RSUs and ISOs.

Work With a Financial Planner to Navigate Personal Situations

As you can see, these decisions can’t be made in a vacuum. This is where you will want to think through and plan for different options. What’s right for someone else may not be right for you. A married couple with two young kids will think about this very differently than someone who is single with no kids.

Your RSUs can have a big impact on your financial situation. They can help you buy a home, pay off debt, put your kids through college, or retire early. If you start early and are proactive about planning, you will have a better chance of reaching your goals and making the most of your RSUs.

Any information contained above should not be construed as tax or legal advice and is provided solely for your convenience. Tax and legal questions should be directed towards your respective tax and legal professionals. This document may contain “forward-looking statements” – that is, statements related to future events. The use of words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," or "target" suggests that potential outcomes are uncertain and actual results may vary materially. Past performance is no indication of future returns and investments can contain significant risk. Losses are always possible, especially over shorter time periods, after periods of extended positive returns, and in specific individual securities. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation.