Welcome to the 4th edition of the Tech Financial Planning Newsletter

We’ve all heard the phrase “cash is king.”

I’d like to take this phrase and put a spin on it.

Enter “cash flow is king.”

In this newsletter we will cover what your cash flow is, why it’s important, and how you can think about different options.

TL;DR

Your cash flow is how you determine where your cash goes each month.

Your cash flow is your superpower. Used correctly, it can set you up for years to come.

Your goals determine how you allocate your cash flow. The recently married couple in their 30s saving for a down payment should manage their cash differently than the family in their 40s thinking about kids education.

What does cash flow mean?

Ask 10 different people and you might get 10 different answers.

Investopedia defines it as “the movement of money in and out of a company.”

Another article defines it as “your income minus your expenses over a certain period of time - typically a month.”

For our purposes, we’ll define cash flow as “how you determine where your cash goes each month.”

Why is this important?

Your cash flow is your superpower.

To steal from Uncle Ben, with great cash flow comes great responsibility.

Used well, your cash flow sets you up for years to come.

But it’s easy to spend everything you take in, with little set aside for saving and investing.

Lately I’ve met with a number of clients and prospects who have big jumps in income. They’ve either taken a new job or got a new promotion. Either way, they are going to be making a lot more than before.

Which is exciting! And over time, something you should anticipate. All things being equal, your income should increase the longer you work as you move up.

But you must plan for these big increases.

A common mistake I see is that when people get a big bonus or pay bump, they keep their savings the same and start to spend the extra. Candidly, you are setting yourself up for failure.

It’s not realistic to assume that you will live on the same income forever. Costs go up, and over time, most people want nicer cars, nicer houses, and nicer trips. And that’s ok. I want people to have fun and spend their hard earned money.

But you need to increase your savings rate accordingly.

Example time. A couple goes from making $300k a year to $500k a year.

A bunch of that extra $200k will go to taxes no matter what. For easy math, lets say there is $120k left over.

The extreme saver will save and invest that extra $120k.

The extreme spender will blow through that extra $120k.

I believe the answer lies somewhere in the middle.

Cash Flow Example

Let’s put this into practice with an example.

Enter Bob & Sue.

Bob & Sue are 38 & 36 respectively. They have two young kids (4 & 1).

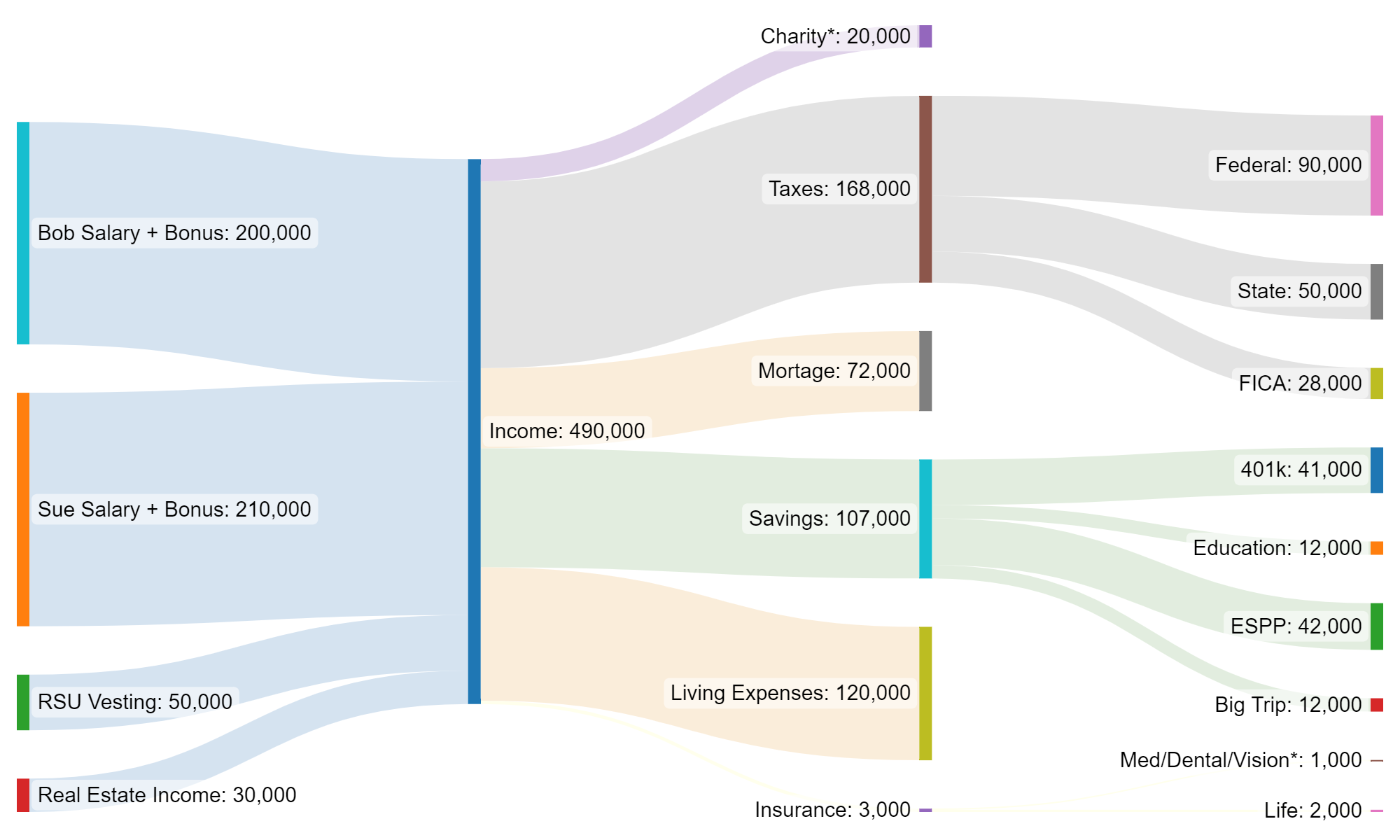

Both work and do quite well. They’ both got promoted recently! Combined they make close to $500,000 between their salary, bonus, RSUs, and real estate.

We know they have some fixed expenses. Think mortgages and taxes at a minimum. This could also include charitable giving and any known expenses like insurance and other debts

So right out of the gate, we have to take out $263,000 (taxes, mortgage, and giving). This leaves us with $227,000.

A cash flow diagram we use with clients to help them visualize where their money is going

We have two main categories left - living expenses and savings.

Bob & Sue live in Southern California, and life is expensive! 2 young kids, and they want to travel and enjoy time with friends. They spend about $10,000 / month or $120,000 / year.

So this leaves us $107,000 a year that’s unaccounted for.

Our goal is to give this money a purpose. Otherwise it can very easily get spent and lost in the cracks of everyday life.

So here’s what we decided to do with Bob & Sue

🟢Maxing out both of their Roth 401ks this year ($20,500 each, for a total of $41,000).

We want to build up as much tax free money in retirement. We are fine maxing these out this year because they don’t have as many big purchases in the next few years (already own their house). Their company plans don’t offer an after tax 401k for the Mega Backdoor Roth.

🟢Maxing out both of their ESPPs (another $42,000 total).

Both of their companies offer a 15% discount, so this is a no brainer for Bob and Sue. But as soon as the ESPP hits, they sell immediately and move the money to their brokerage account.

🟢Putting $6,000 / kid into a 529 account for college ($12,000 total)

Education is important to Bob & Sue. We ran projections and they are on track to fund the majority of their kid’s college education.

🟢Putting away extra for a big trip for Bob & Sue with some friends ($12,000 total)

Have some fun with that money!

Bob & Sue are saving & investing nearly 22% of their total income. The great news is the majority of this is completely automated.

Both the 401k and the ESPP are payroll deductions.

There are auto transfers to the 529 account and to a separate savings account for their big trip.

The only thing they have to do that is active is sell their ESPP once it hits and transfer those funds to their brokerage account. This happens twice a year.

Some possible cash flow tweaks

There’s almost always an opportunity to make some small tweaks to optimize your cash flow. Here are three of our favorites.

1) Don’t max out your 401k.

Particularly if you don’t have enough money for the short and medium term. This is especially important if there are big expenses in the future - down payment for a house, wedding, new car, etc

2) Make sure you aren’t putting too much into savings and cash.

We want to take care of our emergency fund and have enough cash on hand if something big happens. And we want to save for known expenses (again, wedding, car, house, etc). But beyond that, you should have a plan to invest any surplus.

3) Take full advantage of an ESPP with a discount.

We will see people contribute to a brokerage account but they aren’t taking full advantage of their company ESPP. You are typically better off putting money into an ESPP, selling immediately, locking in the discount, then reinvesting.

Putting It All Together

As I have said throughout, your cash flow is your superpower. But you have to use it well.

The problem is that it’s different for every family and their unique circumstances and dreams. It’s not black and white with a clear right answer. It’s a lot of shades of gray and “it depends.”

Your goals and priorities should determine your cash flow. Not “one size fits all” advice from internet gurus and Tik Tok stars.

Nailing your cash flow is what sets you up for financial freedom, both now and in retirement.

Here’s to getting it right!

Any information contained above should not be construed as tax or legal advice and is provided solely for your convenience. Tax and legal questions should be directed towards your respective tax and legal professionals. This document may contain “forward-looking statements” – that is, statements related to future events. The use of words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," or "target" suggests that potential outcomes are uncertain and actual results may vary materially. Past performance is no indication of future returns and investments can contain significant risk. Losses are always possible, especially over shorter time periods, after periods of extended positive returns, and in specific individual securities. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation.