Life rarely stands still, and for Cal and Haley, the past year has been one of big transitions. As a financial advisor, I often work with families who are in the middle of major life changes and feeling the weight of financial uncertainty.

Let’s take a closer look at how we helped Cal and Haley navigate their shifting financial landscape—piece by piece.

Meet Cal and Haley

Cal (39) is a sales director who recently left a decade-long career at a large tech company to join an exciting startup. His wife, Haley (38), made a bold decision to leave her corporate job and return to school to pursue her dream of becoming a nurse. On top of that, their two young kids (5 and 3) have started kindergarten and preschool, adding another layer of change (and expense) to their lives.

With these transitions came some big financial shifts:

Cal's new job brought a promotion and pay increase, but his income is now more variable due to performance-based compensation.

Haley's career pause meant their household income took a temporary dip.

A significant portion of their net worth was still tied up in Cal’s old company’s stock, and they needed a clear strategy for diversification.

Cal’s new role came with a generous stock option package, and they wanted to avoid the costly tax surprises they encountered in the past.

This was a lot to juggle, but by breaking things down into manageable steps, we built a financial plan that gave them confidence and direction.

Step 1: Dialing In Their Cash Flow

A solid financial plan starts with cash flow—knowing what’s coming in, what’s going out, and where it’s going.

We created a simple, automated system for saving, spending, and investing that didn’t feel restrictive.

Since Cal receives quarterly bonuses, we put a proactive plan in place to allocate those funds effectively. This included setting aside a portion for taxes, investing a portion, and reserving some for upcoming expenses.

We built a flexible buffer fund to help smooth out months when Cal’s income fluctuates, providing Haley with peace of mind as she continues school.

Step 2: Diversifying Cal’s Old Company Stock

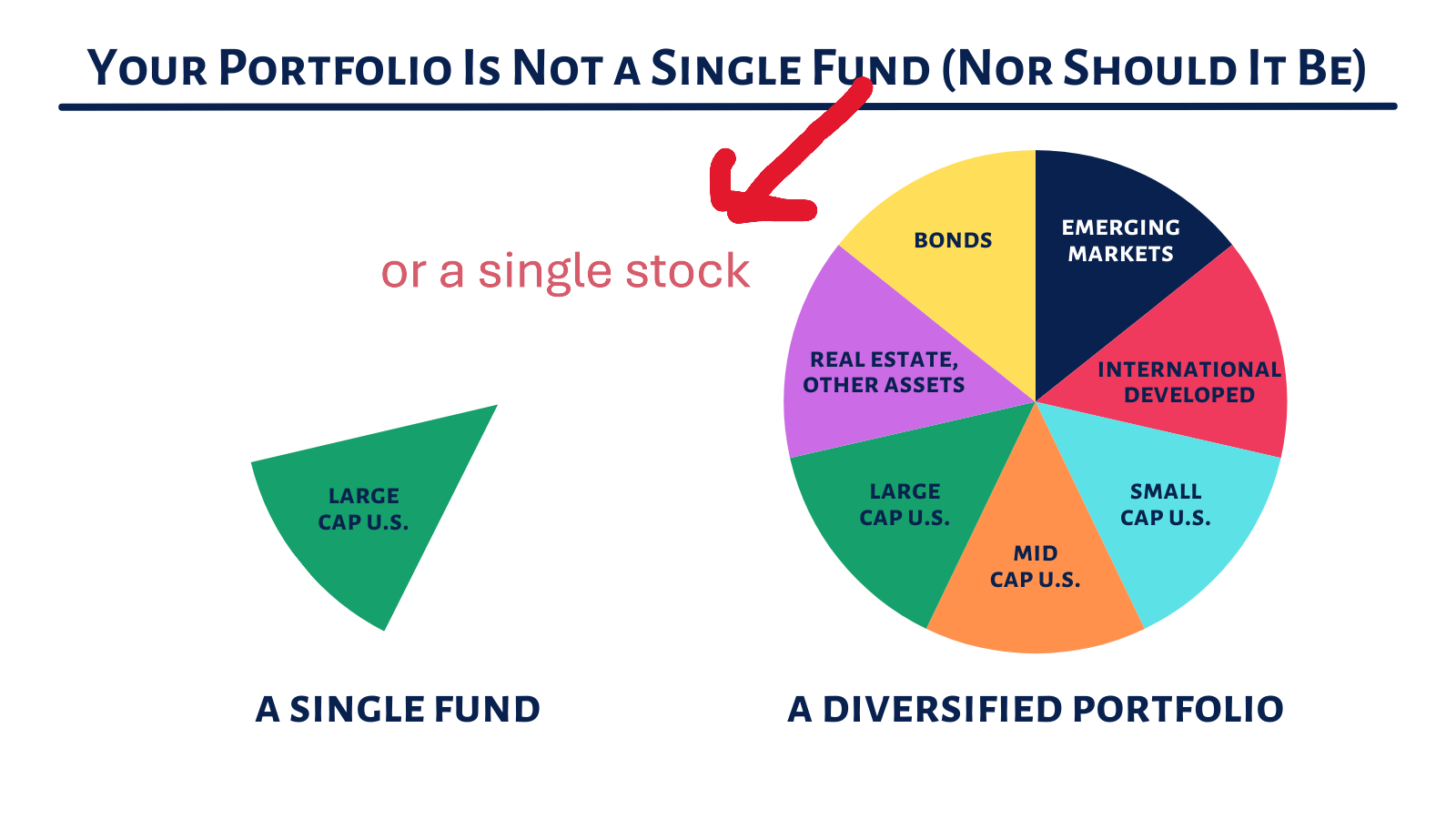

Holding too much stock in a single company—even a former employer—can be risky. But diversifying can also be daunting, especially when faced with potential tax implications.

We implemented a structured plan to sell a set number of shares each quarter, no matter the price. Over the next 2-3 years, this will significantly reduce their exposure.

With each sale, we set aside a portion of the proceeds for taxes, ensuring they wouldn’t be caught off guard.

While they wanted to reduce concentration, they also wanted to retain a smaller portion of the stock for the long term. We factored that into the plan.

Step 3: Proactive Planning for the New Stock Options

Cal’s startup offered an attractive stock option package, but navigating equity compensation requires careful planning.

His options vest over four years with a one-year cliff, so there’s time to strategize.

There was no early exercise provision, so immediate action wasn’t necessary—but planning ahead was.

To avoid triggering a large tax bill, we decided to exercise up to the AMT crossover point each year. This ensures they benefit from their options while managing tax liability efficiently.

More Than Just Numbers: The Real Impact

Beyond the numbers, this planning gave Cal and Haley something even more valuable—confidence and clarity.

After feeling a bit burned out in his last job, Cal is more energized than ever in his new role.

Haley is fully embracing her journey back to school, and you can see her excitement when she talks about her future in nursing.

Their financial plan isn’t just about today—it’s about setting their family up for long-term flexibility and freedom.

Some of their long-term goals are still taking shape, and that’s okay. What matters is that they’re building a financial foundation that allows them to adapt, make choices, and create opportunities for their future.

Feeling Like Cal and Haley? Let’s Talk.

If you’re going through major life changes—whether it’s a job transition, a shift in income, or navigating equity compensation—and you’re not sure where to start, let’s connect. We’ll help you get organized, build a strategy, and take it one step at a time.

Want to chat? Schedule a call and let’s start the conversation.