Read time: 4 minutes

“To be a successful investor, you’ve got to be an optimist. You have to believe in the innovations that come from the human mind and the human spirit.”

Charles Schwab

As we come off a rough 2022 for markets, it’s easy to be pessimistic.

The headlines are almost all bad news

Experts predict a recession

Companies are laying people off

Inflation is still high

Home prices are dropping

And so forth.

I’d like to use this newsletter as a measured case for optimism.

First and foremost, I believe we live in the greatest time in human history.

Jack Raines puts today into perspective when he writes:

“In the United States 100 years ago, women couldn't vote and segregation was the law of the land. 700 years ago, the bubonic plague decimated Europe, wiping out half of Paris's population in just 5 years. If you think Covid-19 is bad, imagine a pandemic that gave you a coin flip's chance of survival in New York City. That was the reality of the world before vaccines, antibiotics, and public sanitation. For most of human history, our chief concerns were finding food and staying warm. There was no time for our post-modernistic search for the "meaning of life."

Now imagine, for a moment, that you are alive and well in a first-world country in the year of our Lord 2023. You have a supercomputer in your pocket that possesses the entirety of human knowledge, our supermarkets contain an assortment of food so grand that King Solomon himself would have been jealous, you can set foot in any country not named North Korea within 24 hours for less than $1,000, modern medicine has rendered former death sentences such as polio all-but-irrelevant, and any and every career path, from medicine to law to rocket science to entrepreneurship awaits you.

An estimated 100,000,000,000 people have walked the earth, including the 8,000,000,000 on the planet right now. 100,000 years of tribal migration, empirical wars, technological advances, and reproductive luck have put you in a position that 99,000,000,000 people couldn't dream of.”

You can quite literally do anything.”

Let’s take a deeper look at quality of living specifically.

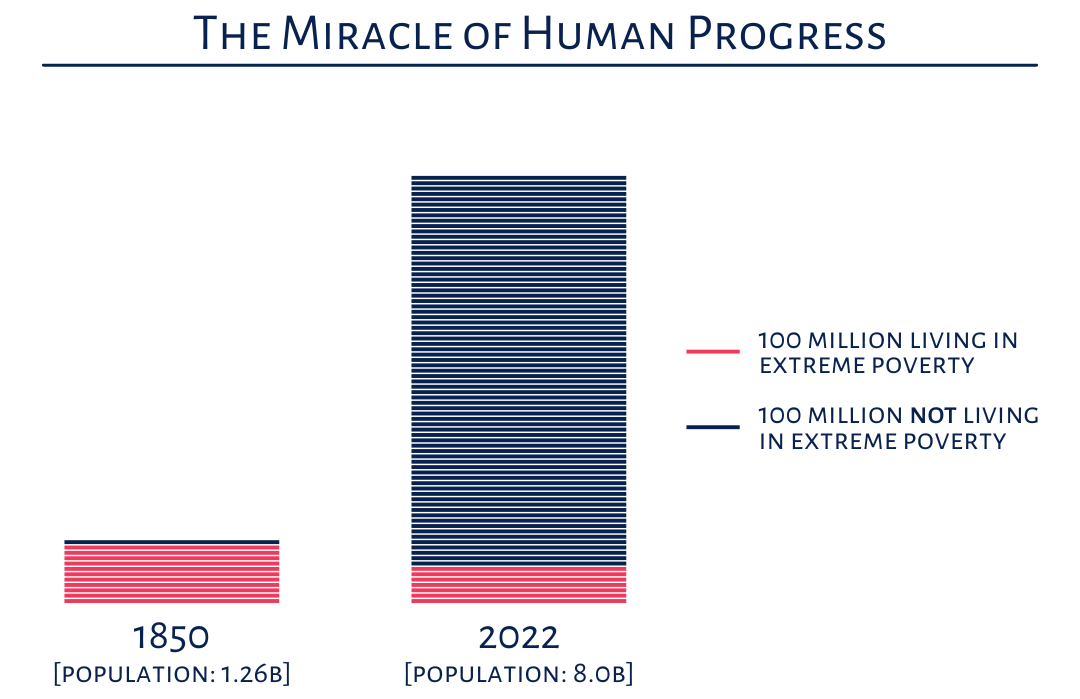

In 1850, the global population was around 1.25 Billion people, and most of them were poor.

Specifically, 1.1 billion (or 87%) of the entire global population lived in extreme poverty.

The world’s population hit 8 billion people on November 15, 2022.

Which means that over the last 170 years, the global population has increased by over 6.75 billion people.

But here’s the most staggering fact.

Despite the absolutely gargantuan increase in population, the number of people living in extreme poverty has dropped to 685 million,

685 million of 8 billion people (8.5%), and I should note, that number continues to drop.

Put simply, the world’s standard of living has improved exponentially over the last 170 years.

This speaks to the absolute incredible feat of human advancement and is undoubtedly one of the great miracles of our time.

Here’s why this matters

Look ahead 10 or 20 or even 30 years.

What do you anticipate?

I believe that cars will be more efficient.

Medicines will get better.

Computers will get faster.

And technological innovations we can’t fathom will continue to revolutionize life as we know it.

This matters because as the world continues to grow and progress, people will make & spend more money, leading to more revenue and profits for companies.

Companies and stocks will continue to grow.

As long term investors (including anyone approaching or in retirement), this is our advantage.

Morgan Housel writes in The Psychology of Money that “The historical odds of making money in the U.S. Markets are 50/50 over one-day periods, 68% in one-year periods, 88% in 10-year periods, and (so far) 100% in 20 year periods.

As I’ve written several times, I have no idea what will happen in the next 6 days, 6 weeks, or 6 months.

Neither does anyone else.

But long term, I’m extremely optimistic.

That doesn’t mean we ignore tough times and invest blindly.

Because on the contrary, if you believe it’s all going to hell, how can you invest?

Buying shares in a company means that you believe they will be more valuable at some point in the future than they are today.

It shouldn’t come as a surprise that I believe the answer is to own the companies that supply nearly everything to the 8 billion people of the world.

As investors with multi-decade (or multi-generational) goals, it is trends like these that are likely to drive the future earnings of the great companies of the world.

The future is bright, my friends.

Whenever you're ready, there are 3 ways I can help you:

1. Connect with me on LinkedIn, where I post every weekday (unless I’m on vacation). https://www.linkedin.com/in/marshalljoe/

2. Subscribe to the “Tech Financial Planning” newsletter to get equity comp and financial planning strategies in your inbox every Saturday. It’s free: TFP Newsletter

3. Want one on one help? Schedule your Get To Know meeting