Read Time: 5 minutes

Welcome to the 39th edition of the Tech Financial Planning (TFP) newsletter.

Over the past few years of working with tech professionals, I’ve discovered a number of myths and half-truths that people believe.

And more importantly, they are driving people’s behavior around money.

In this newsletter, we’ll break down 5 common myths I have heard and why they aren’t true.

TL;DR

Your bonus isn’t taxed more

You don’t need to hold your RSUs to get better tax treatment

Renting is not wasting money

The stock market is not too risky to invest in

Your company stock isn’t necessarily the best investment

Myth 1: My bonus is taxed more

This one is super prevalent, especially in sales.

Back when I was an account executive, I’d remember having a really good month, then getting my commission check and it seemed like EVERYTHING WENT TO TAXES.

So you will often here people say that bonuses are taxed at higher percentages.

That is not true.

Fact 1: all earned income is taxed the same.

The IRS views any bonus (or commission) as earned income, so ultimately you will pay the same amount in tax as if you’d earned it as salary

Fact 2: a bonus might be withheld differently.

The IRS puts bonuses, commissions, and RSUs into a category called “supplemental wages.”

This is where the confusion starts.

Typically, this means your employer will withhold a flat 22% tax for federal taxes.

The problem with this part is that many people do not have a 22% effective tax rate

If your effective rate (not marginal) is below 22%, you will get money back.

If it’s above 22%, you could end up owing more come tax time.

It’s not too different from RSUs vesting

Remember: your bonus is not taxed more, it’s withheld differently.

Myth 2: I need to hold my RSUs for a year because it’s better for my taxes

This is not true.

RSUs are taxed as income when they vest.

If you receive $20,000 worth of RSUs, the IRS views it the exact same as if your company paid you $20,000 cash.

Put another way, if you have a $150,000 salary plus $50,000 in RSUs (or $50,000 in bonus - see #1), it’s the exact same income as $200,000 in salary.

There is 0 tax benefit to holding for 1 day, 1 week, or 1 year.

Only gains are taxed.

If the value of your RSUs are flat when you sell, there are no gains.

But if your RSUs went up to $30,000 in value and you decided to sell, then you would pay taxes on the $10,000 in gains

$10,000 gain = $30,000 current value - $20,000 basis

If you sell within a year or less, you will pay taxes at regular income rates

If you sell after a year, you will pay long term capital gains (usually better)

Remember: you are already paying tax when you get your RSUs.

Whether you sell or hold is an investment and a lifestyle decision, not a tax one.

Myth 3 - Renting is wasting money

Buy vs rent is a spicy topic, particularly when you come across someone who believes it’s always better to buy.

Certainly, buying has been a great decision for many, particularly is you locked in a sub 3% interest rate.

But in today’s market with 6%+ interest rates, in many areas it’s actually significantly cheaper to rent than buy.

In fact, nationwide “the typical home costs 25% more to buy than rent” right now.

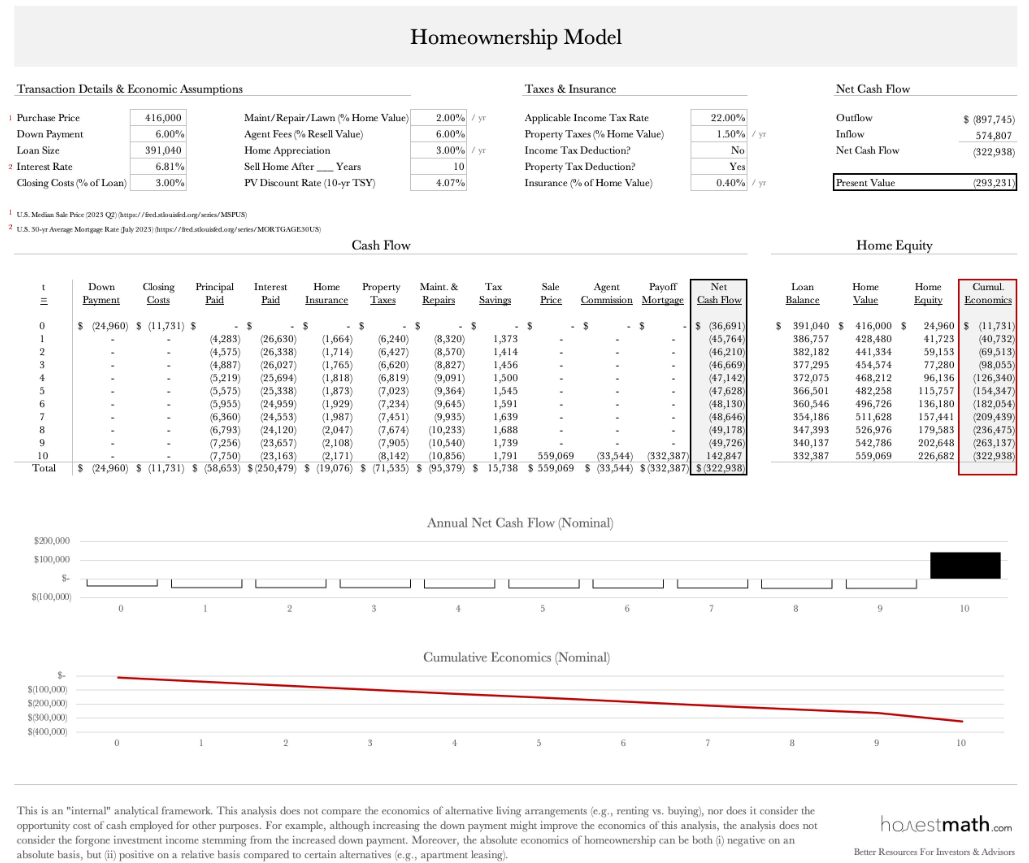

This is a great analysis by Honest Math on Twitter (or X, whatever).

Long story short, in a shorter time period, it’s really hard to make the math work.

In other words, buying is expensive right now in many markets.

There’s so many factors that go into the decision too:

How long you anticipate living in the house (shorter - renting might be better, longer, buying might be better.”

Putting down roots

Wanting something that’s your own

Pets

Flexibility

And so much more.

I won’t go into more detail for the sake of brevity (and not wanting to incur the wrath of the “buying is always better" crowd), plus I’ve already written about it here & here.

Myth 4: The stock market is too risky

Another variation of this is I don’t want to invest because it’s like gambling.

What’s your timeline?

Under 1 year - yeah, probably a bit risky

10+ years - much less risky

In a casino you are almost guaranteed to lose

With patience in the stock market, you are almost guaranteed to make money

We very much want to align our investments with our time frame (again, a big purchase in a year should be invested differently than something 10 years down the road).

But long term, if you aren’t investing, you incur a different risk.

The risk that you won’t have enough money

The real risk for many people is that their money won’t keep up (or outpace) inflation.

Myth 5: My company stock is the best investment

I get it.

You work for the company, you’re excited about the road map, and you believe in where the company is headed.

The problem with this is the odds are stacked against you.

In a 25 year study of 8,000 companies from 1983-2006

64% of stocks underperformed the Russell 3000

Of the 36% that outperformed, only 6% dramatically outperformed

Only 25% of stocks were responsible for all of the market’s gains

39% of stocks were unprofitable, while nearly 20% lost 75% or more!

Geeze, those are a lot of stats and numbers.

In short, the odds that your company is part of the few that significantly outperform is low.

In fact, the odds are much higher that your company stock underforms vs a broadly diversified portfolio.

If you work for Apple or Google or some other wildly successful company, congrats, you are part of the few.

And there’s times where it might be worth taking the risk.

But the single question we must ask - if your company stock tanked (or underperformed, however unlikely you think it is), what would be the effect on you and your family if it did crash?

I’ll end with a story from a friend who went through an IPO from a big public company:

“One of my first jobs was at a big public company who IPO’d during my time there. It had a nice initial pop but it’s had a rocky few years. And for me (and many people in tech), I had too much money tied to one company’s stock. It works great in the good times, but when things inevitably hit a rough patch, it can be a huge hit.

It’s tough to balance enthusiasm for your company with diversification. In hindsight, I drank a bit of the Kool-Aid. As part of the company, you listen to leadership and see what’s on the company road map, so it’s easy to get too excited. Especially when the stock is down.

You think it’s just a matter of time before the stock jumps back up.

If I could do it over, I should have set up a schedule to sell my stock and been disciplined to stick with it. I should have sold more consistently instead of hoping. “

Putting It All Together

Money is difficult.

There’s so much information these days, whether on slack, Tik Tok, the TV, or even conversations with friends and family.

The hard part is, a lot of it sounds true or sounds good.

But taking action on these myths or half-truths can have consequences.

I hope bringing clarity around these topics is helpful for you.

If you have questions about these myths or anything else, reply to this email.

I am here to help!

WHENEVER YOU’RE READY, THERE ARE 3 WAYS I CAN HELP YOU

1. Connect with me on LinkedIn, where I post every weekday (unless I’m on vacation). https://www.linkedin.com/in/marshalljoe/.. Or follow me on Twitter

2. Subscribe to the “Tech Financial Planning” newsletter to get equity comp and financial planning strategies in your inbox. It’s free: TFP Newsletter

3. Want one on one help? Schedule your Get To Know meeting