Read Time: 5 minutes

Welcome to the 36th edition of the Tech Financial Planning (TFP) newsletter.

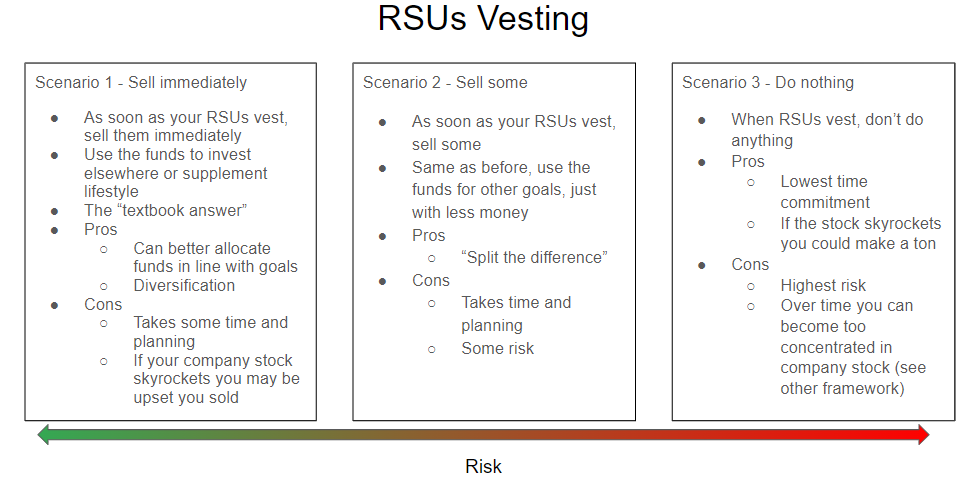

If you receive RSUs, you’ll need to decide what you will do when your shares vest.

Otherwise you may be sitting on a ticking (tax and financial) time bomb.

In this newsletter we’ll break down the 2 questions you should be asking yourself when your RSUs vest, plus 2 planning examples based on client scenarios we’ve worked through.

TL;DR

For high earners, your company likely won’t take out enough in taxes when your RSUs vest - it is crucial to have a plan to pay those remaining taxes

It typically makes sense to sell at least enough vested shares to cover the remaining tax bill

Most people choose to hold some or all of their remaining shares, but you might be better off using some for life goals

How and when will you pay the remaining tax liability on RSU income?

When your RSUs vest, you will have to pay taxes.

This includes both federal, payroll (Social Security and Medicare) and state (if applicable).

Now your company will usually take out some in taxes.

For most people, your company will withhold 22% for federal taxes (as of writing this in 2023, this is the current rate, although this could change).

If you have a high enough income, the withholding rate may be as high as 37%.

However, you might still owe more in taxes.

Let me say it again, just because your company took out some in taxes, doesn’t mean it covers the full amount due.

Come tax time, you can still owe more.

If you are in the 32% tax bracket and your company is only withholding 22%, you will have to make up that missing 10% come tax time.

A quick example.

You receive $100,000 in RSU income this year.

Your company takes out $22,000

$22,000 = (22% tax withholding x $100,000 RSU Income).

However, you actually owe $32,000 this year

$32,000 = (32% marginal tax rate x $100,000 RSU Income).

Which means you have a remaining tax bill of $10,000.

$10,000 remaining = $32,000 total - $22,000 taxes paid

So the question is, how and when will you pay that remaining tax liability?

Some options / ideas

Sell additional shares from vested RSUs, set aside for taxes

Make estimated payments

Increase withholdings on your “regular” paycheck

Use cash on hand

Sell other investments

The big thing is to have a plan for both how and when you will pay this tax liability.

The worst thing you can do is wait until next April and, as luck has it, the stock price falls while your taxes are due.

Now you will have to sell more shares to pay the taxes

Remember - the moment your RSUs vest, you will owe taxes on their total value.

A big myth is that you have to hold your RSUs for greater than 1 year to receive favorable tax status.

Fact - there is no tax advantage to holding the shares an additional day, let alone more than one year.

The only reason to do so is if you believe the stock will outperform the market

What Will You do with your remaining shares?

Hold them all?

Sell them all?

Meg Bartelt asks the question: what will you do with these regular mini-windfalls?

If you decide to sell some / all (or think you might want to) I find it’s really helpful to think about what you will do with that money in advance.

How can your RSUs help you get to your goals quicker?

Your RSUs can become:

A house

A car

A kid’s education

A much needed vacation

An emergency fund

And so much more

As a rule of thumb, I believe you should sell enough to fully cover taxes (if that applies to your tax situation).

Going back to our prior example, if we know we will owe an additional $10,000 in taxes, I would sell $10,000 worth of RSUs to fully cover that tax bill.

Some Planning Examples

Example 1 - sell it all

We work with a client, we’ll call her Sally.

Sally gets about $80,000 worth of RSUs each year.

Life is looking to be really expensive over the next couple of years - wedding, car, and maybe even a house!

She is also a really high earner, and should be in the 32% or 35% tax bracket.

We are using her vested RSUs to create a cash bucket for the next couple years.

Even though her company withholds some in taxes, it won’t be enough - some back of the napkin math shows she could still owe $10,000.

So once she receives her shares, we immediately sell them all.

She sets aside a portion into her “taxes” bucket and puts the rest into her “big life stuff” bucket.

We have the confidence that we are saving enough for taxes and the upcoming milestones.

Plus, she’s saving enough in other areas of her life.

example 2 - sell some, keep some

On the other hand, we also work with Bill and Sue.

Bill gets about $200,000 worth of RSUs each year.

Before we started working with Bill and Sue, he was holding every single share, even though he’s in the top tax bracket (37%).

Minus the 22% the company automatically takes out in taxes, Bill and Sue are keeping the rest in company stock

He is pretty optimistic about the future of his company, but also realizes the importance of diversification.

Bill and Sue also have some debt they want to pay off.

So when Bill’s RSUs vest, we meet to “break up” the remaining shares

22% the company takes out for taxes

15% to additional taxes

25% to debt

18% to brokerage

20% - keep in company stock

So with $200,000 in RSUs, this looks like:

Candidly, I’d like them to keep 10% and diversify even more, but that’s ok.

We’ve made huge progress - we are holding $116,000 less of company stock and better aligning it with Bill and Sue’s priorities.

The beauty of this is that it isn’t static!

If the stock price jumps (or falls) we will revisit this plan and adjust accordingly.

Putting It All Together

What will your RSUs become?

A significant bet on your company?

A big life goal?

Some combination of both, or something else entirely?

Not planning is a decision in itself - a decision to get a tax surprise (likely taxes owed, but for lower earners, possibly a refund) and a bet on your company.

If your company is the next Apple or Microsoft, then you made the right bet.

But for most people I find that we can better align some of your RSU income with your life + goals.

How cool would it be to have your RSUs buy you your forever home or put your kids through college?

Feeling Stuck With Your RSUs?

If you're a tech employee and want to work 1:1 on:

Building a systematic approach to building wealth

Making the most of your RSUs (and not getting blindsided with taxes)

Maximizing your cashflow

I only take on 1-2 clients each month.