Welcome to the 11th edition of the Tech Financial Planning (TFP) Newsletter.

At this point, everyone is pretty aware that interest rates have gone up a ton this year.

There’s certainly been some downsides, like mortgage rates skyrocketing.

But one positive is that there is finally a chance to earn some money on your cash.

In this newsletter we will break down 3 opportunities for your cash, so you can make more money.

TL;DR

High yield savings accounts are a much better alternative to traditional banks right now

US Treasurys provide some great yield

I-Bonds are super popular right now (with reason), but they aren’t the easiest.

High Yield Savings Account

“The best high-yield savings accounts help you grow funds faster than average accounts. The products featured on this page have annual percentage yields, or APYs, of around 2%. That is many times more than the national average of 0.17%.” —Nerd Wallet

A quick note: During a time when interest rates have increased by about 2.25% on nearly everything we need loans to obtain, banks are not raising rates on the money they are lending against. Not to name names, but the two largest banks in the United States make these averages look generous. It's shocking.

A quick google search will provide a number of potential options (I’m a fan of Nerd Wallet and Bankrate to review your options).

As of writing, you should probably be looking for something in the 2.25% to 2.5% interest range.

I don’t have experience with all of them, but I’ve heard favorable opinions about Ally, Marcus by Goldman Sachs, and SoFi.

US Treasury Securities

These are a little bit more complicated than your typical savings account, but if you have a lot of cash (perhaps you are saving for a house), the juice can be worth the squeeze.

Treasury securities are some of the safest investments out there because they are backed by the U.S. government.

Treasury securities are split up into three primary categories based on the length of maturity: Treasury Bills, Treasury Bonds, and Treasury Notes.

All of these can be purchased directly from the U.S. government on the website, TreasuryDirect.gov, or through a bank or broker (I’d probably recommend the latter).

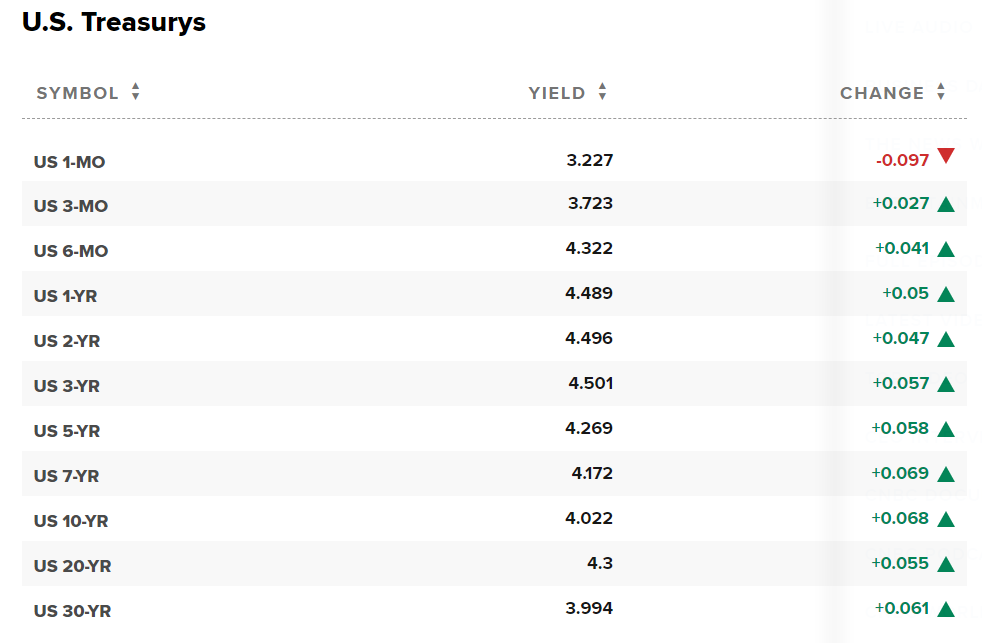

Right now, these have a decent yield.

A 1 year treasury (as of 10/14) has a yield of 4.489%, nearly 2% higher than most of the high yield savings accounts.

But it does take more time and effort to manage.

So if you have $5,000 set aside, it might not be worth it. But if you have $100,000, now it gets interesting.

I bonds

Series I bonds are designed to protect you from inflation.

With an I bond, you earn both a fixed rate of interest and a rate that changes with inflation

Few investments have gotten more hype this past year, and rightly so.

The current interest rate is 9.62%.

So what’s the catch? Why aren’t we putting every last dollar into I bonds?

A couple things to note:

Can only be purchased through the U.S. Treasury website, and from everything I’ve heard, it’s really cumbersome

There’s a purchase limit of $10,000 per person each year. Plus an addition $5,000 in I Bonds if you use your tax return

The money is tied up for at least 1 year - you can’t sell until after 12 months.

If you cash out before 5 years, you will lose the last three months of interest.

The interest rate changes every six months, based on inflation reports. So while the interest rate is high right now, if/when inflation is lower, the interest rate will also go lower

If I had to sum up why I-bonds shouldn’t (or can’t) be your only strategy right now, it’s because the purchase limits are relatively low and your money is locked up for a year.

Don’t get me wrong, I bonds are great, but they need to be complimented with something else.

Putting It All Together

Depending on how much cash and how much effort you want to put into, there’s some decent opportunities for your cash.

With a number of clients, we are using a combination of all three.

Here’s an example:

Clients are saving to buy a house in the next 2-3 years aka big cash need

Emergency fund (typically 3-6 months of living expenses) in a high yield savings account

Selling RSUs and ESPP as they vest. Purchasing $10,000 worth of I bonds (or if married with kids, $10,000 per person). Anything above that, purchasing 1 year treasurys.

While this won’t get them rich overnight, it’s certainly a better alternative than throwing it all in a traditional bank’s savings account where it makes practically nothing.

Some of this can certainly be a pain, but there are multiple ways to earn much more interest on your cash if you're willing to make a change.

I’d argue it is.